Qubit: Y Combinator Startup Investing Chart

This chart by Chartr is one of the best depictions of startup investing during the Covid era.

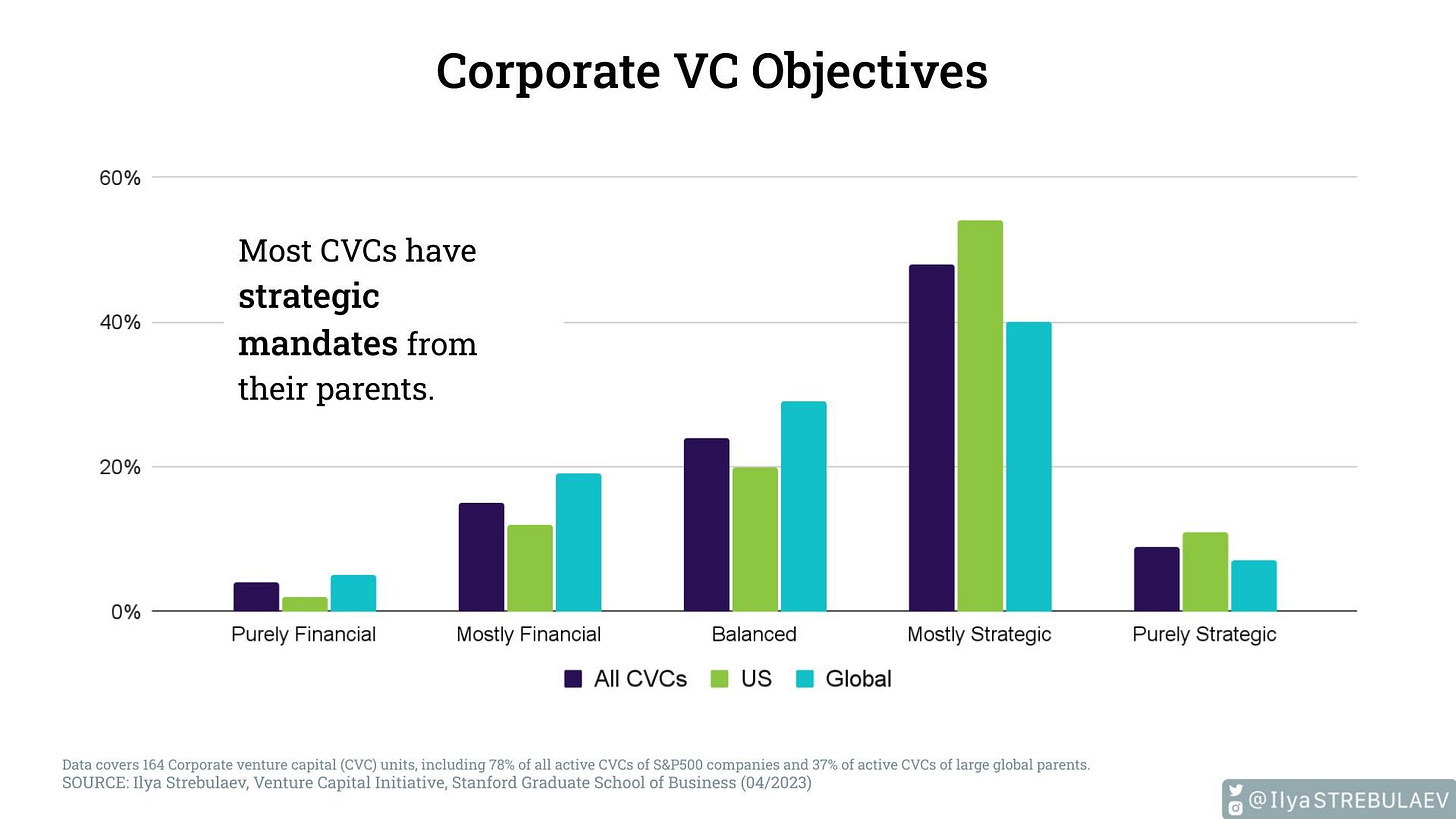

Y Combinator has made over 2,400 investments in the last 5 years. If it did not set the trend in what types of startups to invest in, it did influenced what the venture industry paid attention to. In turn, it also influenced what kinds of startups were formed because that’s what the “market” wanted.

Separately, a YC company called Snappr created a Y Combinator Database with more lists and charts. One chart compares exit values versus funding across YC Companies, which is another good example of the Covid era. As these companies stayed private longer they raised more capital, mainly from non-traditional investors.

“Having now funded over 4,000 startups, with a combined valuation exceeding $600bn, it’s almost guaranteed that everyone in America has used at least one product from its portfolio of companies. If you’ve booked a holiday on Airbnb, ordered food through DoorDash or paid for something online with Stripe, you have YC to (partly) thank.

Although the specific investment terms have changed through the years, YC’s strategy has been consistent and it perfectly encapsulates investing in risky start-up companies: many will fail, most will be unspectacular, and a handful will (hopefully) be home runs that pay for everything.

While the earliest cohorts were just a handful of companies, the most recent batches have been in the hundreds — YC’s startup directory lists more than 2,400 investments from just the last 5 years. It’s safe to assume that there’s already a future success like Airbnb, Reddit, Twitch or Stripe in one of those batches.”

Source:

Chartr Newsletter - March 17, 2023

Y Combinator - Startup Directory

The Y Combinator Database - Comparing Exit Value vs Funding across YC companies

Tweets and Posts:

Qubits are insights that we find and share with you.